More than half of Tempe houses are renter occupied. Our unhoused and working class communities, students, and small business owners will be forced to move in search of more affordable housing.

Commuting in and out of downtown Tempe, Phoenix, or utilizing major interstates will be chaotic and inconvenient with the development of the proposed district, also worsening our air quality.

The entertainment district is on the centerline of our state’s busiest airport runway and will reduce flight safety for pilots flying out of PHX Airport.

This development project is one of the largest in the nation and it has not taken our limited resources or climate change into consideration – water cuts have already begun in surrounding cities.

Campaign contributions to elected officials from corporations and CEOs leads to our representatives acting in favor of corporate interest instead of the interest of the people. Learn about AZ Coyotes’ CEO Alex Meruelo’s and his Living Trust’s campaign contributions.

We shouldn’t be rewarding Vegas gambler Alex Meruelo’s predatory bad business with a 30-year tax break! He was kicked out of Glendale for not paying taxes and rent on time.

The State Press: 3/20/23

Tempe Independent: 4/12/23

Business Journal: 3/21/23

State Press: 4/26/23

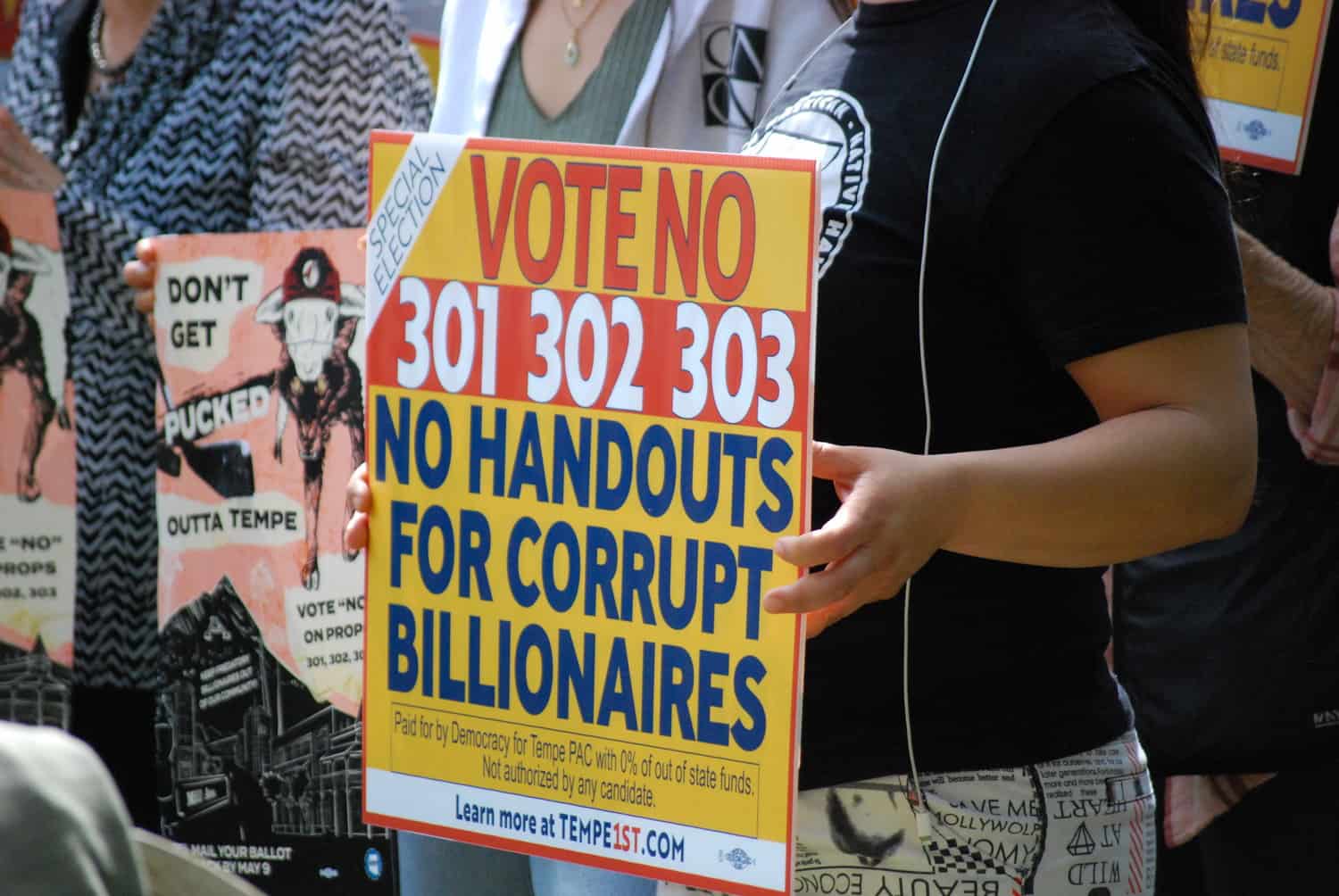

Tempe residents will be deciding on whether or not the Arizona Coyotes will receive two GPLETs, one for 8 years (retail, hotel, residential, office buildings) and another for 30 years (arena, music venue, and Coyotes facilities). According to the Goldwater Institute, GPLETs are widely abused in Tempe and Phoenix, in order to hide property from the tax rolls and “unfairly shift the tax burden to existing residents and businesses.” At a time when people are struggling to make ends meet, we shouldn’t be cutting out potential resources that would improve our quality of life.

GPLETs are often used as a tax abatement scheme by large corporations to remove commercial properties off of the tax roll for a certain period of time, depending on the deal the corporations negotiate with the government. This gives large corporations an unfair advantage and makes it difficult for small businesses to compete. When local governments offer tax incentives to businesses, it diverts resources away from public services such as education, healthcare, and infrastructure. This has a massive negative impact on low-income communities, which rely more heavily on public services.

When local governments offer tax incentives to businesses, it can create a race to the bottom, where different cities compete to offer the most generous tax breaks. This can lead to a situation where corporations are not paying their fair share of taxes,exacerbating wealth inequality. There is some evidence that GPLETs may not be effective at creating the promised economic benefits like job creation. This means that the tax breaks are not benefiting the broader community, but rather only the corporations that receive them.